Kaspa Fundamentals

What is Kaspa?

Kaspa is a cryptocurrency. It is the fastest, open-source, decentralized & fully scalable Layer-1 in the world. The world’s first blockDAG – a digital ledger enabling parallel blocks and instant transaction confirmation – built on a robust proof-of-work engine with rapid single-second block intervals.

Kaspa is a proof-of-work cryptocurrency which implements the GHOSTDAG protocol. Unlike traditional blockchains, GHOSTDAG does not orphan blocks created in parallel, but rather allows them to coexist and orders them in consensus. Whereby Kaspa is actually a blockDAG; you can see GHOSTDAG in action in a real time blockDAG visualizer.

This generalization of Nakamoto consensus allows for secure operation while maintaining very high block rates (currently one block per second, aiming for 32/sec, with visions of 100/sec) and minuscule confirmation times dominated by internet latency (cf. chapter 6 of the research paper for some initial benchmarks).

Visit this informative website about Kaspa at http://kaspa.org.

Video Explanations:

Who founded Kaspa?

Yonatan Sompolinsky founded Kaspa.

Learn about Yonatan here.

Here are some videos featuring Yonatan Sompolinsky on YouTube:

DAG Knight presentation - CESC Day 1 w/ Yonatan Sompolinsky

Rethink Trust 2018: Yonatan Sompolinsky, Interview

Yonatan Sompolinsky at Australian Crypto Convention

Uphold Institutional x Kaspa - Dr Martin Hiesboeck Interview with Yonatan Sompolinsky

Kaspa Israel Meetup - February 2024 - Part 3 of 4 - Yonatan Sompolinsky

Layer 1s Still Matter? Yonatan Sompolinskyi from Kaspa shares thoughts

What does a DAG look like?

You can look at an animation of the DAG visualizer here: https://kgi.kaspad.net/

Also, check out Kaspa Network Visualization and see how the DAG looks at different block speeds: https://macmachi.github.io/kaspa-network-visualizer/

Kaspa Graph Inspector also has a visual animation showing how Kaspa works: http://rustforce1.kaspa.org:8080/

How fast is Kaspa?

Explore Kaspa's speed vs other Proof of Work (PoW) or Proof of Stake (PoS). Kaspa network is set to hardfork in April 2025 to accommodate 10 BPS. Further down the road, it will accommodate 100 BPS.

Block Speed Visualizer: https://kaspaspeed.com/

What was Satoshi’s vision?

Satoshi's vision was to make people more free by creating a peer-to-peer electronic cash system that operates without intermediaries (banks, governments, or centralized entities). It ensures financial sovereignty, censorship resistance, and decentralization, allowing anyone to transact freely.

At the core of Nakamoto’s idea (it remains unknown whether they are a real person or a group of developers) was the goal of creating a decentralized electronic cash system independent of third parties. It would allow money to be sent directly, without intermediaries such as banks. Nakamoto wasn’t the first person (or people) to set out to create a decentralized system, but he is the first to have seen fit to use the proof-of-work consensus mechanism. (Source: https://tangem.com/en/blog/post/the-godfather-of-consensus-a-guide-to-proof-of-work/)

How does someone avoid a scam?

- Be skeptical of unsolicited messages or offers.

- If it sounds too good to be true, it probably is.

- Verify sources before clicking links or sending funds.

- Use well-known, trusted channels and community-verified resources.

- Never share private keys or seed phrases.

- DYOR (Do Your Own Research) before investing in anything.

Where can I learn about mining Kaspa?

From the KaspaWiki site, "Kaspa is currently only mineable with ASICs. Initially, it was possible to mine it with CPUs and even on mobile devices, and then with GPUs. However, those times have long since passed (they ended around mid-2023) because ASICs—specialized mining machines—have taken over most of the Kaspa network's hashrate. Technically, it is still possible to mine Kaspa with a GPU or even a CPU, but this endeavor results in a negative profit: you would end up paying more for electricity than you could possibly acquire by selling the mined Kaspa. Therefore, it is wiser to use the same money to directly buy Kaspa; this way, you will have more Kaspa in your possession."

For more information about how to get started mining Kaspa, visit: https://wiki.kaspa.org/en/mining

Articles:

How To Mine Kaspa: A Step-by-Step Guide

Understanding Kaspa Mining

What is Kii?

The Kaspa Industrial Initiative (Kii) is a foundation committed to leveraging Kaspa’s high-performance Directed Acyclic Graph (DAG)-based Distributed Ledger Technology (DLT) to drive innovation and efficiency across key industrial and enterprise sectors.

Kii is building a global network of companies, leaders and academics to champion the adoption of Kaspa’s next-generation platform.

Our aim is to position Kaspa as the ultimate base layer for various applications, fostering a robust ecosystem that unlocks unprecedented levels of scalability, security, and decentralisation for industrial and enterprise applications in finance, supply chain, energy, and the public sector, while promoting sustainable and ethical development.

For more information, check out Kaspa Industrial Initiative (Kii).

What is Warpcore?

WarpCore is a special, easy-to-use middleware running on Kaspa’s cutting-edge blockDAG architecture, creates a direct pathway from established financial institutions to modern digital money networks—such as those running on blockchains—enabling banks and large financial companies to seamlessly plug in their existing systems and rules, send, receive, and manage digital assets without confusion or extra hassle, and adhere to global standards everyone can trust.

More than just a compliance tool or performance upgrade, WarpCore fundamentally rethinks how institutions engage in the digital economy; by uniting regulatory-grade standards with Kaspa’s highly scalable, decentralized network, it empowers financial institutions to operate confidently in a new era of global finance—making not just a step, but a leap into the future of digital assets without sacrificing trust, transparency, or performance.

Learn more at Kaspa Industrial Initiative: WarpCore.

Is there a Kaspa documentary?

Producers are currently fundraising to create a documentary about Kaspa titled Beyond the Blockchain: The Lore of Kaspa.

You can learn about it by watching this video:

A Look Into The Kaspa Documentary Being Created By Genesis Block Media

Documentary Proposal PDF

Community Funding Form

Community Contributor Form

For more information about the documentary, visit: https://www.genesisblockmedia.com

What is the Kaspa Ecosystem Foundation?

The Kaspa Ecosystem Foundation (KEF) provides funding, resources, and guidance. It upholds impartial principles to support the Kaspa ecosystem and advance its mission of becoming a widely used currency for everyday transactions.

KEF aims to collaborate with the community to promote the development, adoption, and sustainability of the Kaspa ecosystem, empowering individuals and organizations to leverage Kaspa technology for a robust and diversified ecosystem. A flourishing Kaspa ecosystem benefits all stakeholders. Miners gain from increased transaction activity. Holders enjoy speculative gains. Investors find opportunities in high-quality projects. Merchants boost sales with Kaspa’s expanding influence. KEF supports the Kaspa ecosystem through various means:

- Research Grants

- Developer Support/Hackathons

- Startup Incubation

- Merchant Integration

For more information, please visit the Kaspa Ecosystem Foundation's official website.

What is kHeavyHash?

Kaspa utilizes the custom-built kHeavyhash mining algorithm. The kHeavyhash process is a matrix multiplication, sandwiched between two standard Keccak hashes (often referred to as SHA-3). This particular algorithm is computationally intensive – which enables Kaspa to be dual-mined alongside cryptocurrencies that utilize memory-intensive mining algorithms. Kaspa’s kHeavyhash is extensively supported by experienced & industry-leading kernel developers, and is integrated in numerous mining software solutions as standalone & dual-minable. Source: https://kaspa.network/mining/

What is the Nakamoto Consensus?

The Nakamoto Consensus refers to the set of rules and mechanisms that allow a decentralized network to achieve agreement. Here’s a breakdown of its key features:

Proof-of-Work: At its core, the Nakamoto Consensus utilizes the proof-of-work algorithm, which requires participants (miners) to solve complex mathematical problems to validate transactions and create new blocks.

Decentralization: This consensus mechanism allows anyone to join the network and participate as a node, promoting a decentralized and permissionless environment.

Security and Integrity: By requiring significant computational effort to add new blocks, the Nakamoto Consensus helps secure the network against attacks, ensuring that altering any part of the blockchain would require an impractical amount of resources.

Chain Selection Rule: In the event of competing chains (forks), the Nakamoto Consensus dictates that the longest chain (the one with the most accumulated proof-of-work) is considered the valid one.

Innovation: It incorporates various innovative ideas that distinguish it from earlier digital currencies, making it a unique and robust protocol.

Articles:

What Is the Nakamoto Consensus? (Binance Blog)

What Is Nakamoto Consensus And How Does It Power Bitcoin?

What is Nakamoto Consensus? The Mechanism that Powers Bitcoin

What is Nakamoto Consensus? Securing Trust in Decentralization

Understanding the Nakamoto Consensus

Video Explanations:

Bitcoin FAQ: What is the Nakamoto Consensus? (Short video)

Cryptoeconomics - 3.2 - Bitcoin: Nakamoto Consensus (Longer video)

How does Nakamoto Consensus differ from Committee-Based Consensus?

Nakamoto Consensus and DAGKNIGHT w/ Yonatan Sompolinsky

What is Kaspa pruning?

According to Shai Deshe Wyborski: "Pruning" is the idea that it is unreasonable, unscalable, and ultimately centralized to require all full nodes to store all historical data indefinitely. "Rollups" are the idea that it is unreasonable, unscalable, and ultimately centralized to require full nodes to process the entire logic of the entire ecosystem just to verify its consistency. In both cases, finding an alternative that is comparably secure is very hard, but not impossible. In both cases, teams developing Kaspa and over Kaspa managed to provide such alternatives (standing on the shoulders of preexisting pieces of the puzzle like MLS and ZK). Immutable ledgers and on-chain computation are not the defaults. They are just compromises made due to lack of better solutions. Preferred just because they are the most conceptually simple solutions (despite this simplicity just delegating infinitely deep problems to other components, e.g. regulating processing via gas fees that are provably impossible to compute in the general case). A reality that has since changed, despite some people insisting to stay behind. Source: https://x.com/DesheShai/status/1895492007721685181

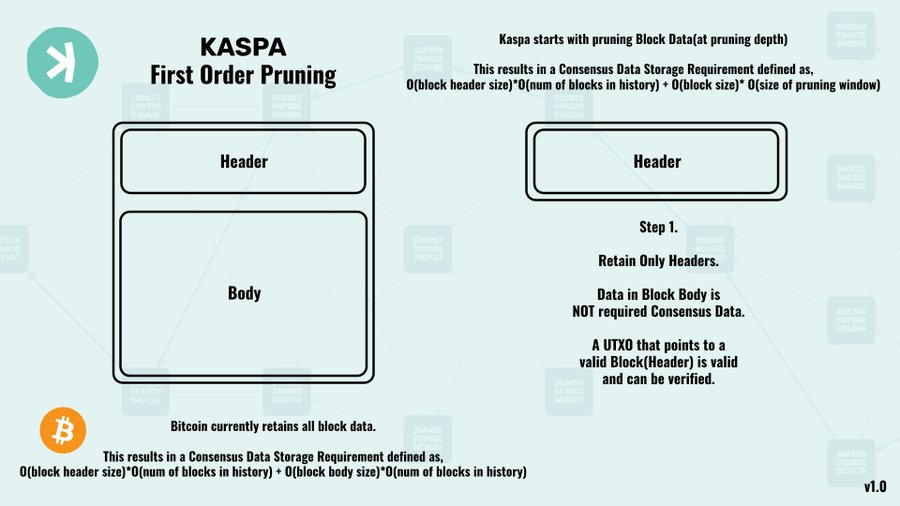

According to @KaspaFacts via X: Kaspa separates the Application Data and Consensus Data (at the pruning point). Application Data (UTXOs, account balances, and contract state) As old UTXO's are used up, they are no longer retained. Consensus Data (block headers) MLS adapted for DAG provides PoPoW without keeping ALL headers. Application Data only keeps living information. Consensus Data only keeps enough historical information to prove the work that has gone into the DAG up to the pruning point. Transactions go in the body. All the rest of the information about the block goes in the header (Parent, Mergeset, Miner, Links to previous blocks, etc.). The header is then hashed with a nonce to create a hash that is at least of the required difficulty. Source: https://x.com/KaspaFacts/status/1895521775255241006

Infographic source: https://x.com/KaspaFacts/status/1895528566181544083

Video:

Kaspa Pruning Explained

Kaspa Pruning

Kaspa Pruning Explained

KASPA PRUNING FUD DEBUNKED!! THIS IS WHY KASPA WILL BE NUMBER 1!! *MUST WATCH!*

Example:

This example was randomly pulled from the Block Explorer: https://explorer.kaspa.org/blocks/0059a769a07e82a1e9754ce8ced4a81b254c11f17859f15a4e3553b567025de5

Is KIP6 part of Crescendo?

No. You can read the full discussion about this on Telegram (view discussion here) and read what Kaspa developers are saying about KIP6 (Source: https://x.com/MichaelSuttonIL/status/1895152997149352000)

Cryptographic receipts (KIP6) will provide means to prove the existence of data retroactively, but it is the responsibility of whoever wants to retain it, not of the entire network to indefinitely store it for them. (Source: https://x.com/DesheShai/status/1895494539420283005)

Crypto Basics

What is spot trading?

Buying and Selling in the Here and Now

Spot trading is the most straightforward way to buy and sell cryptocurrencies. It involves instantaneous transactions where you purchase a cryptocurrency at the current market price, with the goal of holding it or selling it for a profit. Think of it like buying a coffee at a cafe - you pay the price listed on the menu and get your coffee right away.

Here's how it works:

- Choose a cryptocurrency exchange: Platforms like Kraken and Uphold allow you to buy and sell cryptocurrencies.

- Fund your account: You'll need to deposit funds (usually fiat currency like USD or EUR) into your exchange account.

- KYC: You may be asked to verify your identity through KYC (Know Your Customer).

- Place an order: You can choose to buy or sell a specific cryptocurrency at the current market price.

- Transaction confirmation: Once your order is placed, it's immediately executed at the prevailing market rate. You now own the cryptocurrency!

- Withdraw your funds to your wallet and do not leave it on an exchange.

Advantages of Spot Trading:

- Simplicity: It's a straightforward process, easy for beginners to understand.

- Transparency: You know exactly what you're buying and at what price.

- Liquidity: Spot markets generally have high liquidity, meaning you can buy and sell quickly without impacting the price significantly.

Disadvantages of Spot Trading:

- Price volatility: Cryptocurrency prices can fluctuate rapidly, leading to potential losses.

- Market risk: Spot trading involves the risk of losing money if the price of the cryptocurrency you buy drops.

Spot trading is a good option for:

- Short-term traders: Those looking to capitalize on price fluctuations.

- Long-term investors: Those who believe in the long-term value of a cryptocurrency.

Spot trading is not suitable for:

- Risk-averse investors: Those who cannot tolerate price volatility.

- Those seeking high returns quickly: Spot trading does not offer quick, guaranteed profits.

What is KYC?

KYC stands for "Know Your Customer." It is a process used primarily in the financial services industry to verify the identity of clients. This process helps institutions understand their customers and their financial dealings to prevent fraud, money laundering, and other illicit activities. KYC processes help assess the risk associated with a customer. This includes evaluating the customer's financial history and the nature of their transactions. KYC is not a one-time process. Institutions continuously monitor transactions to ensure they align with the customer’s profile and to detect any suspicious activity. KYC is mandated by various regulations worldwide, requiring financial institutions to implement these procedures to comply with anti-money laundering (AML) laws. Adhering to KYC regulations helps institutions avoid legal penalties and maintain their reputation.

Financial institutions must collect and verify specific information about their clients. This typically includes:

- Name

- Date of Birth

- Address

- Identification Number (like a Social Security Number or passport number)

When you undergo identity verification, you are often asked to provide a driver's license and show the front and back of the card, and sometimes you are asked to provide a selfie.

What is a crypto exchange?

A crypto exchange is an online platform where users can buy, sell, or trade cryptocurrencies. Similar to traditional stock exchanges, crypto exchanges facilitate the exchange of digital assets by matching buyers with sellers. Users can trade a variety of cryptocurrencies like Kaspa, Bitcoin, Ethereum, and others for fiat currencies like USD or EUR, or swap between different cryptocurrencies. Exchanges vary in their offerings; some focus on providing a wide range of digital assets, while others might specialize in particular types of trading, like decentralized finance (DeFi) tokens or NFTs. They typically offer features such as order books, where detailed information about buy and sell orders is displayed, trading pairs, wallet services for storing assets, and sometimes advanced trading options like margin trading or futures.

Security is paramount in crypto exchanges due to the high value and digital nature of cryptocurrencies. Most platforms implement measures like two-factor authentication (2FA), cold storage for a majority of user funds to protect against hacks, and insurance policies to cover potential losses. Some exchanges operate centrally (CEXs), where a company manages the platform, holding users' funds in their custody, while decentralized exchanges (DEXs) allow users to retain control of their assets through smart contracts on blockchains, minimizing trust in a central authority. User interfaces can range from simple for beginners to complex for professional traders, with additional services like staking, lending, or earning interest on crypto holdings often integrated to attract users.

Is a crypto exchange the stock market?

A crypto exchange is not the same as the traditional stock market, although they share some similarities in function. Both are platforms where assets are bought, sold, and traded, but they deal with fundamentally different types of assets. A stock market primarily deals with shares of publicly traded companies, bonds, and other securities, where ownership represents a claim on a company's assets and earnings. In contrast, a crypto exchange facilitates the trading of cryptocurrencies, digital or virtual currencies that use cryptography for security and operate on decentralized networks like blockchains. The value of stocks is often tied to the performance and health of the issuing companies, while the valuation of cryptocurrencies can be influenced by a broader set of factors including technology adoption, regulatory news, market sentiment, and speculative trading.

Moreover, the operational mechanics of crypto exchanges versus stock markets differ significantly. Traditional stock markets are highly regulated with standardized listings, trading hours, and oversight by bodies like the SEC in the U.S. Crypto exchanges, while increasingly under regulatory scrutiny, often operate around the clock, with less uniform regulatory standards across different jurisdictions. They can be centralized, where a company manages the exchange, or decentralized, where transactions occur directly between users via smart contracts without a central authority. This decentralization aspect introduces both opportunities and challenges not typically seen in stock markets, such as higher volatility, different security concerns, and unique trading practices like atomic swaps or liquidity pools in DeFi.

What is 1 BPS and 10 BPS?

In Kaspa, 1 BPS and 10 BPS refer to Blocks Per Second, indicating how quickly the network can generate and confirm new blocks. At 1 BPS, Kaspa would be creating one block every second, which already signifies a significant departure from the slower block times of traditional blockchains like Bitcoin (1 block every ~10 minutes) or Ethereum (pre-Ethereum 2.0, around 15 seconds). The ability to produce blocks at this rate showcases Kaspa's innovative BlockDAG (block directed acyclic graph) architecture, which allows for parallel block creation, thereby enhancing the network's throughput and reducing confirmation times for transactions.

Achieving 10 BPS would mean Kaspa is producing ten blocks every second, a rate that would put it at the forefront of blockchain technology in terms of speed and scalability. This high block production rate is crucial for Kaspa because it directly translates into the capacity to handle a high volume of transactions efficiently, with lower fees and minimal congestion. This efficiency is particularly advantageous for applications requiring fast transaction confirmations, like microtransactions, gaming, or any real-time financial services, making Kaspa an attractive platform for developers and users looking for performance beyond what traditional blockchains can offer.

Why do exchanges, such as Binance and Coinbase, list futures before spot listings?

The short answer is: They want to test the waters. Futures often face fewer legal restrictions than spot trading.

Leverage trading generates more fees and liquidations, so there are higher profits for the exchange. Exchanges gauge interest before committing to full Spot support. Futures allow speculation without requiring actual $KAS currency.

The long answer is far more nuanced. Here are some explanations as well as some helpful articles that help shed light on this common question.

The Game Behind Memecoin Listings: Why Futures First, Spot Later? (Read this article to discover the mechanics behind coin listings on major exchanges like Binance and Kraken. Learn why some coins get listed on futures before spot, the challenges memecoins face, and strategies for navigating this volatile market.)

Crypto Spot Trading vs Crypto Futures Trading: Differences Explained (Read this article to learn some fundamental differences between spot and futures trading. This describes the financial incentive for perpetual futures. The exchange makes money no matter what and could liquidate your position on paper (synthetic, unbacked asset).

Crypto Spot vs. Crypto Futures Trading: What's the Difference? (Read this Binance Blog article to learn the difference between the two.)

Perpetual Futures: What They Are and How They Work (Read this Investopedia article to learn...)

Video Explanations:

Futures Trading vs. Spot Trading (Everything You Must Know)

Spot vs Futures trading. What's the difference in crypto trading?

What is the difference between cryptocurrency spot trading and futures trading?

Bitunix Guide to Spot and Futures Trading Differences

Understanding Spot vs. Futures Listings

Spot Listing:

Investors directly own the token and can withdraw it from the exchange. Spot trading creates real demand and reduces circulating supply, increasing token scarcity and potentially driving up the price.

Futures Listing:

Investors trade contracts based on the token's price rather than owning the token itself. While futures trading generates volume and interest, the funding rate often limits sustained price increases.

Key Difference:

Spot listings create tangible demand by locking up tokens, whereas futures listings focus on speculative trading.

Why Futures Listings Come First:

Risk Mitigation for Exchanges:

Trading can be emotionally taxing, especially in a volatile market. Having a solid risk management plan can help traders stick to their strategies and avoid impulsive decisions driven by fear or greed. Cryptocurrencies are known for their high volatility, which can lead to significant price swings in a short period. This unpredictability can result in substantial losses for traders if not managed properly. Many futures contracts allow traders to use leverage, meaning they can control a larger position with a smaller amount of capital. While this can amplify profits, it also increases the potential for losses, making risk management essential.

The crypto market can be susceptible to manipulation due to its relatively low liquidity compared to traditional markets. This can lead to sudden price changes, necessitating strategies to protect against unexpected movements. In futures trading, there is a risk that the other party in the transaction may default. Effective risk mitigation strategies help to minimize this counterparty risk. The regulatory environment for cryptocurrencies is still evolving. Changes in regulations can impact market conditions, making it important for traders to have risk management strategies in place.

Liquidity Testing:

Exchanges use futures markets to gauge demand, liquidity, and stability for a token before committing to a spot listing.

Volatility Management:

Memecoins are notoriously volatile. Futures markets allow exchanges to test market resilience without the complexities of managing token withdrawals.

Operational Complexity:

Spot listings require exchanges to manage wallet integrations for deposits and withdrawals, which can be challenging for tokens with unique technologies (e.g., DOG on Bitcoin Ordinals or Rune Protocol).

Why Listing on Binance is Challenging for Some Coins :

High Listing Costs and Listing Fees:

Binance may demand up to 8% of the token's total supply as a listing fee.

Refundable Collateral:

Projects often need to stake $5 million in BNB as collateral, refundable only if the token is delisted.

Marketing Budget:

Projects must allocate an additional 8% of their supply for promotions like airdrops and platform marketing campaigns. In total, projects need to allocate up to 16% of their total supply, plus a significant upfront financial commitment. This creates a substantial barrier for most new coins, particularly those with decentralized ownership.

Decentralized Tokenomics:

Memecoins like DOG often distribute tokens across hundreds of thousands of wallets, making it nearly impossible to meet the 8% token supply requirement for Binance’s listing criteria.

Centralized Teams:

In contrast, Solana-based memecoins often have centralized teams that retain a portion of tokens specifically to meet exchange requirements. Kaspa is not centralized and does not pay for listings.

Liquidity Concerns:

Memecoins often experience FOMO-driven trading, leading to sharp but short-lived trading volume spikes. Binance prioritizes projects with stable, sustainable liquidity to ensure long-term trading activity.

Perpetual Contracts:

Perpetual contracts are what you will see across different cryptocurrency exchanges. A Perpetual future contract is also known as a perpetual swap. It is the most popular crypto derivative out there. Crypto future contracts are perpetual swaps that don’t have an expiry date. You can keep your positions open for as long as you wish to. However, you will be required to pay holding fees or the funding rate. Also, your crypto account must contain a minimum amount known as a margin. Plus, apart from the funding rate, you also have to trade fees.

What is decentralization?

Crypto decentralization refers to the distribution of control, authority, and operations across a network of participants rather than relying on a single central entity, such as a government, bank, or company. In the context of cryptocurrencies and blockchain technology, it means that no single party has complete dominance over the system—data, transaction validation, and network governance are managed collaboratively by a dispersed group of nodes (computers) running the blockchain software. This is achieved through consensus mechanisms like Proof of Work (PoW), Proof of Stake (PoS), or Kaspa's BlockDAG, where participants agree on the state of the ledger without needing a central intermediary.

Decentralization Use:

Government:

Instead of one central authority making all the decisions, power is shared among different levels of government.

Technology:

Blockchain is a decentralized system that records transactions in a way that can't be changed, making it more secure and transparent.

Finance:

Cryptocurrencies are decentralized, meaning they're not controlled by any single bank or government.

Podcasts/Audio Chats:

Kaspa Weekly Chat with Luke Discussing Decentralisation (Host: XXIM - Decentralise Capitalism)

Video Explanations:

What Is DECENTRALIZATION in Crypto, Exactly?? Explained in 3 mins

Decentralization Explained - How Blockchain Technology Works

What Makes Kaspa The Most Decentralized Cryptocurrency?

Why Kaspa Is Leading The Decentralization Revolution In Crypto

What Actually Makes Bitcoin Decentralized?

Kaspa: A Cryptocompany Or Cryptocurrency?

What are the benefits of decentralization?

Decentralization offers key benefits:

It enhances security by eliminating single points of failure, making the system more resistant to hacks, censorship, or shutdowns; it promotes transparency, as all transactions are recorded on a public ledger accessible to anyone; and it empowers users by giving them direct control over their assets without reliance on trusted third parties.

For example, in a decentralized cryptocurrency like Bitcoin, users can send funds globally without bank approval, and the network continues to operate as long as enough nodes remain active. However, the degree of decentralization varies—some networks may still have centralized elements like development teams or large stakeholders influencing decisions. In essence, crypto decentralization aims to create a trustless, peer-to-peer system where power is distributed, fostering autonomy and resilience.

- More efficient: Everyone can work on their own tasks without waiting for someone else to tell them what to do.

- More flexible: If one person can't make it, the others can still keep things running.

- More diverse: Different people bring different ideas and perspectives, leading to a more interesting and successful event.

Video Explanations:

Advantages of Decentralization

Why Decentralized Trading? | Benefits of Decentralization | The Academy

The Benefits of Decentralization and Why Systems Should Be Decentralized

BENEFITS of decentralization

a16z’s Head of Policy on the Benefits of Decentralization | The Scoop Highlight

[WEBINAR] The major benefits of decentralization for brands and consumers with Tyler Moebius

What is the difference between centralized and decentralized cryptocurrencies?

Centralized and decentralized cryptocurrencies differ fundamentally in their structure, control, and operation. Centralized cryptocurrencies prioritize efficiency and control, requiring trust in a central authority, while decentralized ones emphasize autonomy, security, and transparency, distributing power among participants at the potential cost of speed or complexity.

Decentralized Cryptocurrencies:

- No single entity controls the network; authority is distributed across a network of nodes run by independent participants. Bitcoin and Ethereum (post-merge with PoS) are prime examples, where miners or validators collectively maintain the system.

- Transactions are validated through a consensus mechanism (e.g., PoW, PoS, or BlockDAG) by multiple nodes, ensuring no single point of control but potentially slower processing compared to centralized systems, though networks like Kaspa aim to mitigate this with high throughput.

- More resilient due to distributed nodes; an attack must compromise a majority of the network (e.g., 51% attack) to succeed, enhancing security through redundancy.

- Governance is often community-driven, through mechanisms like DAOs or consensus among stakeholders, which can be slower but aligns with user interests over time.

- Offers censorship resistance; transactions can occur globally without interference as long as the network remains active, promoting financial inclusion.

- Often faces scalability challenges (e.g., Bitcoin’s 7 TPS limit), though innovations like Kaspa’s BlockDAG aim to balance speed with decentralization.

Centralized Cryptocurrencies:

- Managed by a single entity (e.g., a company or organization) that has authority over the network, including transaction validation, issuance, and governance. Examples include Ripple (XRP) to some extent, where Ripple Labs plays a significant role, or stablecoins like USDC managed by Circle.

- Transactions are processed and approved by the central authority, often leading to faster processing but requiring trust in that entity. The central body can reverse or block transactions if needed.

- Vulnerable to single points of failure—hacks, regulatory shutdowns, or mismanagement can compromise the entire system. Security depends heavily on the central entity’s safeguards.

- Typically fully transparent, with all transactions recorded on a public blockchain, reducing the need for trust in any single party.

- Decisions about updates, policies, or token supply are made by the controlling entity, allowing quick adaptations but potentially prioritizing the entity's interests.

- The controlling entity can restrict access, freeze accounts, or censor transactions based on internal policies or external pressures (e.g., government regulations).

- Generally more scalable and efficient due to centralized servers handling operations, but this comes at the cost of decentralization trade-offs.

Video Explanations:

Centralization vs Decentralization

The Benefits of Decentralization and Centralization | The Unstoppable Podcast Clips

Exploring the Benefits and Difficulties of Decentralization

What is the difference between Centralized vs. Decentralized Exchanges (CEX) vs. (DEX)?

Centralized Exchanges (CEX) and Decentralized Exchanges (DEX) differ fundamentally in their structure, operation, and philosophy within the cryptocurrency trading ecosystem. CEXs prioritize ease of use, speed, and liquidity at the cost of user control and privacy, relying on a trusted intermediary. DEXs emphasize decentralization, security, and autonomy, aligning with blockchain’s ethos but often sacrificing convenience and scalability unless enhanced by advanced blockchain tech like Kaspa’s BlockDAG.

Decentralized Exchanges (DEX):

- Run on blockchain protocols with no central authority holding funds. Users retain custody of their assets in their own wallets, and trades occur directly between users via smart contracts (e.g., Uniswap, PancakeSwap).

- More secure from centralized hacks since funds stay in users’ wallets. However, users bear responsibility for their private keys, and vulnerabilities in smart contracts can be exploited if not audited properly.

- Slower and less scalable historically due to on-chain transaction processing, though layer-2 solutions and high-throughput blockchains (e.g., Kaspa) are improving this. Liquidity depends on user participation in pools.

- Less user-friendly, often requiring wallet integration (e.g., MetaMask) and blockchain knowledge, with no direct customer support, though interfaces are improving.

- Generally permissionless and anonymous, with no KYC unless mandated by specific jurisdictions, enhancing user privacy.

- Often employs Automated Market Makers (AMMs) with liquidity pools instead of order books, where prices are set algorithmically based on supply/demand in the pool, or peer-to-peer order matching on some platforms.

- Resistant to censorship since no central entity can intervene; operates as long as the blockchain does, though regulatory scrutiny is increasing.

- Fees are typically lower (e.g., gas fees on the blockchain plus a small protocol fee), but they vary with network congestion and can spike during high demand.

Centralized Exchanges (CEX):

- Operated by a centralized company (e.g., Binance, Coinbase) that holds custody of users’ funds. Users deposit assets into the exchange’s wallets, and the platform manages them, acting as an intermediary for trades.

- Vulnerable to hacks targeting the exchange’s central servers or mismanagement by the operator. While security measures like 2FA and cold storage are common, a breach can affect all users (e.g., Mt. Gox hack).

- Typically faster and more scalable due to centralized servers handling trades off-chain or with optimized systems, offering high liquidity and advanced trading features like margin trading.

- User-friendly with intuitive interfaces, customer support, and fiat on-ramps (e.g., USD to crypto), making it accessible for beginners.

- Requires Know Your Customer (KYC) verification, collecting personal data to comply with regulations, reducing privacy.

- Uses an order book model where buy/sell orders are matched centrally, often with the exchange acting as a market maker to ensure liquidity.

- Subject to government regulations, can freeze accounts, block transactions, or delist assets under pressure, offering less censorship resistance.

- Charges trading fees, withdrawal fees, and sometimes deposit fees, set by the operator, which can be higher but predictable.

Video Explanations:

Centralized vs. Decentralized Exchanges: Pros and Cons

Difference Between Centralized and Decentralized Exchanges

What is a CEX?

A Centralized Exchange (CEX) is a cryptocurrency trading platform operated by a single entity or company that facilitates the buying, selling, and trading of digital assets like Bitcoin, Ethereum, and various tokens. Unlike decentralized systems, a CEX acts as an intermediary, holding custody of users’ funds in its own wallets after users deposit their cryptocurrencies or fiat money (e.g., USD). It manages trades through a centralized order book, matching buy and sell orders to ensure liquidity, often acting as a market maker itself. Examples include Binance, Coinbase, and Kraken.

A CEX offers a user-friendly interface, high transaction speeds due to off-chain processing, and additional features like fiat on-ramps, margin trading, and customer support, making it appealing to beginners and professional traders alike. However, it requires users to trust the exchange with their assets, subjecting them to risks like hacks (e.g., past incidents like Mt. Gox), regulatory actions, or account freezes. To mitigate risks, reputable CEXs implement security measures such as two-factor authentication (2FA), cold storage for most funds, and sometimes insurance. They also typically enforce Know Your Customer (KYC) requirements to comply with regulations, reducing user privacy but aligning with legal frameworks. A CEX provides convenience and efficiency at the expense of full decentralization and user control.

Video Explanations:

What is CEX? Short review centralized crypto exchange

What are Centralized Cryptocurrency Exchanges & How Do They Work ?

Centralized Cryptocurrency Exchanges: Explained

What is a Centralized Crypto Exchange?

What is a DEX?

A Decentralized Exchange (DEX) is a cryptocurrency trading platform that operates without a central authority, enabling peer-to-peer trading directly between users on a blockchain. Unlike centralized exchanges, a DEX does not hold custody of users’ funds; instead, users retain control of their assets in their personal wallets (e.g., MetaMask) and execute trades via smart contracts. Popular examples include Uniswap, SushiSwap, and PancakeSwap. Trades are often facilitated through Automated Market Makers (AMMs), where liquidity pools—funded by users—determine prices algorithmically, or through on-chain order books in some cases, rather than a centralized matching system.

DEXs align with the ethos of decentralization, offering greater privacy (typically no KYC required), censorship resistance, and security against centralized hacks, as funds aren’t stored on the platform. However, they can be less user-friendly, requiring familiarity with blockchain wallets and transaction fees (e.g., gas costs on Ethereum), and may suffer from lower liquidity or slower speeds unless built on high-throughput blockchains like Kaspa. Security depends on smart contract integrity—flaws can be exploited—and users must manage their own private keys, adding personal responsibility. DEXs empower users with autonomy and are integral to DeFi ecosystems, supporting activities like token swaps, yield farming, and staking, all while minimizing reliance on intermediaries.

Video Explanations:

What is a Decentralized Exchange DEX?

What is a DEX? How A Decentralized Exchange Works

What is a DEX? A Decentralised Exchange Explained!

Decentralized Cryptocurrency Exchanges: What is a DEX and How to Use it?

How does a DEX work?

What is a DEX? (CRYPTO DEFI simplified)

Decentralized Exchanges (DEXs) Explained - Everything You Need to Know About Decentralized Exchanges

What is Proof of Stake?

Proof of Stake (PoS) is a consensus mechanism used in blockchain technology to validate transactions and create new blocks. It’s an alternative to the more traditional Proof of Work (PoW) system. Here’s how it works and why it’s significant:

How Proof of Stake Works:

- Validators: Instead of miners competing to solve complex mathematical problems (as in PoW), PoS selects validators based on the amount of cryptocurrency they hold and are willing to "stake" as collateral.

- Staking: Users lock up a certain amount of their cryptocurrency in the network. The more you stake, the higher your chances of being chosen to validate the next block of transactions.

- Block Creation: When a validator is selected, they confirm transactions and add them to the blockchain. In return, they earn transaction fees and sometimes additional cryptocurrency as a reward.

- Security: If a validator acts dishonestly or tries to cheat the system, they can lose their staked coins, which helps maintain the integrity of the network.

Benefits of Proof of Stake:

- Energy Efficiency: PoS is much less energy-intensive than PoW since it doesn’t require massive computational power (although Kaspa actually changes this and requires less computational power since it confirms blocks faster).

- Decentralization: It encourages more participants to join the network, as anyone with a stake can become a validator.

- Scalability: PoS can handle more transactions per second compared to PoW, making it more suitable for larger networks.

Popular Cryptocurrencies Using PoS:

- Ethereum: Transitioned from PoW to PoS with its Ethereum 2.0 upgrade.

- Cardano: Uses a unique PoS protocol called Ouroboros.

- Polkadot: Implements a variant of PoS called Nominated Proof of Stake (NPoS).

Video Explanations:

What is Proof of Stake (PoS)|Explained For Beginners

What is Proof of Stake? How it works (Animated)

What is Proof of Stake - Explained in Detail (Animation)

What is Proof of Stake - Explained in 3 Minutes (Animation)

What is the difference between PoS and PoW?

PoS stands for Proof of Stake.

PoW stands for Proof of Work.

Proof of Work (PoW) and Proof of Stake (PoS) are two primary consensus mechanisms used by blockchains to validate transactions and secure the network, but they differ significantly in their approach, energy use, and operation.

Proof of Work:

- Miners compete to solve complex mathematical puzzles using computational power. The first to solve it adds a new block to the blockchain and earns a reward (e.g., Bitcoin). This process, called mining, requires significant energy and hardware.

- Usually highly energy-intensive due to the continuous operation of powerful hardware (e.g., ASICs or GPUs), contributing to environmental concerns. Bitcoin’s network, for instance, consumes energy comparable to some countries. Kaspa alters this dynamic through its BlockDAG technology, which enables much faster block confirmations—currently 1 block per second (1 BPS), with plans to reach 10 BPS or more. While Kaspa still uses PoW with the kHeavyHash algorithm, its rapid block rate reduces the energy per transaction by distributing the computational effort across frequent, lightweight blocks rather than infrequent, resource-heavy ones. Additionally, kHeavyHash is designed to be energy-efficient compared to SHA-256 (Bitcoin’s algorithm), and Kaspa’s roadmap includes compatibility with photonic mining, which could further slash energy use by leveraging light-based computation. Although mining Kaspa still requires hardware like GPUs or ASICs today, the combination of high throughput and an efficient algorithm means it consumes less energy per unit of work than traditional PoW systems, mitigating some environmental impact while preserving security.

- Security stems from the difficulty and cost of solving puzzles, making a 51% attack expensive as it requires controlling most of the network’s hash power. Kaspa, a proof-of-work (PoW) cryptocurrency, enhances security against 51% attacks through its unique BlockDAG architecture and GHOSTDAG protocol, building on the core principles of PoW security. Like traditional PoW systems (e.g., Bitcoin), Kaspa’s security stems from the computational effort required to solve cryptographic puzzles, with miners contributing hash power to validate transactions and create blocks. A 51% attack, where an attacker controls over half the network’s hash power to rewrite the ledger, remains costly because acquiring and sustaining that level of computational resources is resource-intensive and economically challenging as the network grows. What sets Kaspa apart is its BlockDAG structure, which allows parallel blocks to coexist rather than orphaning them, unlike Bitcoin’s linear blockchain. The GHOSTDAG protocol orders these blocks in a directed acyclic graph (DAG), favoring well-connected honest blocks over isolated adversarial ones. This design reduces the effectiveness of orphaned blocks, a vulnerability in traditional PoW where attackers can exploit high orphan rates to reduce the hash power needed for a 51% attack (sometimes less than 51% due to orphaned honest blocks slowing the chain). By integrating all blocks into the DAG and maintaining a high block rate—currently 1 block per second, with goals of 10 BPS or more—Kaspa increases throughput without sacrificing security. The rapid block production and connectivity make it harder for an attacker to outpace the honest network, as they cannot leverage honest blocks effectively, a property formalized as the “freeloading bound” in GHOSTDAG. Thus, Kaspa’s security aligns with PoW’s high-cost barrier to 51% attacks while mitigating some traditional weaknesses, making it theoretically as secure as Bitcoin but with superior scalability.

- In traditional PoW systems like Bitcoin, security and block creation demand specialized, high-performance hardware (e.g., ASICs), which indeed favors those with access to significant resources and cheap electricity. This can lead to centralized mining power, as large-scale miners or pools in regions with low-energy costs dominate the network’s hash rate. Kaspa also uses PoW, employing the kHeavyHash algorithm, which currently requires computational resources like GPUs or ASICs for mining. As with other PoW cryptocurrencies, this setup could theoretically centralize mining power among those with access to advanced hardware and affordable electricity, especially as ASIC miners (e.g., IceRiver KS series or Bitmain’s Antminer KS3) have entered the Kaspa ecosystem. However, Kaspa’s design and future compatibility with photonic-based mining introduce a potential divergence. The kHeavyHash algorithm is intentionally crafted to be energy-efficient and forward-compatible with optical Proof of Work (OPoW), a next-generation mining approach using silicon photonics. Photonic mining, still in development by organizations like POWX, leverages light-based computation rather than traditional electron-based processing, promising dramatically lower energy consumption. Photonic miners would need infrastructure like photonic chips, power sources (potentially solar), and integration with Kaspa’s network—it could shift mining from an energy-intensive operational cost model to a capital expenditure model (e.g., investing in photonic hardware). This aligns with Kaspa’s goal of democratizing mining, as reduced energy demands could lessen the advantage of cheap electricity regions, potentially decentralizing participation if the hardware becomes widely accessible. However, until photonic miners are commercially available, Kaspa’s mining remains tied to conventional hardware, with centralization risks similar to other PoW systems.

- Traditional Proof of Work (PoW) blockchains like Bitcoin indeed face scalability limitations due to their time-intensive puzzle-solving process, which restricts transaction throughput to around 7 transactions per second (TPS). This bottleneck arises because PoW relies on a linear blockchain where miners compete to add one block at a time, often with significant intervals (e.g., Bitcoin’s ~10 minutes per block), and orphaned blocks further reduce efficiency. The sequential nature of block creation inherently caps the number of transactions processed, prioritizing security over speed. Kaspa revolutionizes this with its BlockDAG (block directed acyclic graph) technology and the upcoming DAGKnight protocol, significantly boosting throughput while maintaining PoW security. Unlike a linear chain, BlockDAG allows multiple blocks to be created and confirmed in parallel, with Kaspa currently achieving 1 block per second (1 BPS) and aiming for 10 BPS or higher. This parallelism, governed by the GHOSTDAG protocol now and soon enhanced by DAGKnight, integrates all valid blocks into the ledger rather than discarding orphans, effectively increasing TPS far beyond traditional PoW limits—potentially into the thousands. DAGKnight further refines this by improving security and responsiveness to network conditions, adapting dynamically to prevent attacks while sustaining high throughput. By decoupling block production from transaction bottlenecks, Kaspa offers a scalable PoW solution that retains miner-driven security without the usual trade-off of slow transaction speeds.

Proof of Stake:

- Validators are chosen to create new blocks based on the amount of cryptocurrency they hold and “stake” (lock up) as collateral. Selection can be random or weighted by stake size (e.g., Ethereum post-merge), eliminating the need for computational competition.

- Far more energy-efficient, as it relies on staking rather than computation, requiring only minimal power to run validator nodes, making it a greener alternative.

- Security relies on economic incentives—attackers must own and stake a majority of the cryptocurrency, risking loss of their stake through penalties (slashing) if they act maliciously.

- Requires minimal hardware, just a standard computer or server, lowering the entry barrier and allowing broader participation.

- Faster block creation and higher scalability potential, as validation doesn’t depend on computation, enabling networks like Ethereum to aim for greater efficiency.

- Rewards miners with newly minted coins and transaction fees, incentivizing hardware investment and energy use.

- Rewards validators with transaction fees or staking rewards, encouraging coin ownership and network participation over resource consumption.

Article:

Deep Dive: Why Proof-of-Work (Bitcoin & Kaspa) is Superior to Proof-of-Stake for Truly DeFi

Video Explanations:

Kaspa Becoming The Standard For Proof of Work (PoW vs. PoS)

Proof-of-Stake (vs proof-of-work)

Kaspa Vs Ethereum (Proof of Work Vs Proof of Stake)

Kaspa vs Traditional Proof of Work: Why It’s a Game Changer!

Kaspa Bad For The Environment? (PoW vs PoS)

What is Proof of Work?

Proof-of-Work (PoW) is a consensus mechanism used in blockchain networks to validate transactions and secure the network without relying on a central authority. In PoW, miners—participants in the network—compete to solve complex mathematical puzzles using computational power. The first miner to solve the puzzle gets to add a new block of transactions to the blockchain and is rewarded with cryptocurrency, such as Bitcoin in its network. This process requires significant energy and computing resources, ensuring that altering the blockchain (e.g., through a 51% attack) is extremely costly and difficult, thus providing security through economic incentives and decentralization. PoW was pioneered by Bitcoin and remains a foundational concept in many cryptocurrencies, valued for its robustness and resistance to manipulation, though it’s often criticized for its energy intensity and scalability limitations.

How Kaspa Differs and Is More Revolutionary Than Traditional PoW

Kaspa is a next-generation blockchain that builds on the PoW framework but introduces revolutionary changes to address the shortcomings of traditional PoW systems like Bitcoin. Here’s how it differs and why it’s considered groundbreaking:

- BlockDAG Structure vs. Linear Blockchain

Traditional PoW blockchains, like Bitcoin, operate on a linear chain where only one block is added at a time, and any competing blocks (orphans) are discarded. This limits transaction throughput and leads to slower confirmation times (e.g., Bitcoin’s 10-minute average). Kaspa, however, uses a BlockDAG (Directed Acyclic Graph of Blocks) structure powered by its GHOSTDAG protocol. Instead of rejecting parallel blocks, Kaspa incorporates them into the ledger, allowing multiple blocks to coexist and be ordered in consensus. This dramatically increases scalability and speed, enabling Kaspa to process blocks at a rate of one per second currently, with plans to reach 32 or even 100 blocks per second after its Rust rewrite. - Unprecedented Speed and Scalability

While traditional PoW struggles with the blockchain trilemma—balancing decentralization, security, and scalability—Kaspa claims to solve it. Its BlockDAG architecture allows for near-instant transaction confirmations (around 10 seconds for full confirmation, with visibility in 1 second), compared to Bitcoin’s 10 minutes. This makes Kaspa far more practical for real-world use cases like peer-to-peer payments, all while retaining PoW’s security and decentralization. Unlike Ethereum, which shifted to Proof-of-Stake (PoS) to address scalability, Kaspa achieves this within a PoW framework, preserving the original Nakamoto vision. - No Orphan Blocks

In traditional PoW, orphan blocks—blocks mined simultaneously but not included in the main chain—waste computational effort and reduce efficiency. Kaspa’s GHOSTDAG protocol eliminates this inefficiency by integrating all valid blocks into the BlockDAG, ensuring every miner’s work contributes to the network. This not only boosts throughput but also enhances fairness and decentralization by reducing the advantage of high-powered miners. - Energy Efficiency Innovations

Though still energy-intensive like all PoW systems, Kaspa employs the kHeavyHash algorithm, designed to be lightweight and compatible with optical mining hardware in the future. This could potentially lower energy demands compared to traditional PoW algorithms like Bitcoin’s SHA-256, making it a forward-thinking evolution of the model. - Enhanced Decentralization and Fairness

Traditional PoW networks can centralize over time as miners with more resources dominate block creation, especially with slow block rates. Kaspa’s high block rate (one per second) reduces variance in mining rewards, leveling the playing field for smaller miners and solo operators. This aligns with the original ethos of cryptocurrency as a decentralized, accessible system.

Why It’s Revolutionary

Kaspa’s approach is revolutionary because it reimagines PoW’s potential rather than abandoning it, as many newer blockchains have done with PoS. By generalizing Bitcoin’s Nakamoto Consensus into a BlockDAG via GHOSTDAG, Kaspa achieves what was once thought impossible: a PoW system that rivals the speed and scalability of PoS networks without sacrificing security or decentralization. It positions itself as a “Bitcoin 2.0”—not a replacement, but an evolution—that could redefine PoW’s role in the future of blockchain technology. With ongoing upgrades like its transition to Rust for even greater performance, Kaspa is pushing the boundaries of what PoW can accomplish

Articles:

Beyond Bitcoin: Kaspa’s Ascent in the Proof-of-Work Realm

What Is Proof-of-Work (PoW) and How Does It Work in 2024?

Kaspa: The Fastest Proof-of-Work Layer 1 Blockchain

Video Explanations:

Kaspa vs Traditional Proof of Work: Why It’s a Game Changer!

Iceriver- Conventional Wisdom About Proof-Of-Work (and how Kaspa proves it wrong)

The godfather of consensus: A guide to proof-of-work

What is Proof of Work? (Cryptocurrency Explanation)

Proof of Work in Blockchain

Proof of Work

Proof Of Work In Blockchain | What Is Proof Of Work | Proof Of Work Explained | Simplilearn

What is Proof of Work : Explained for Beginners by animation

Proof of Work in Blockchain Technology

How does Proof of Work ACTUALLY Work?

Shai Wyborski - Kaspa at Australian Crypto Convention

What is DeFi?

DeFi, short for Decentralized Finance, refers to an ecosystem of financial applications and services built on blockchain technology that operate without traditional intermediaries like banks, brokers, or centralized institutions. Instead, DeFi uses smart contracts—self-executing code on a blockchain—to enable peer-to-peer financial activities such as lending, borrowing, trading, yield farming, and asset management. It leverages the transparency, security, and immutability of blockchains (most commonly Ethereum) to create an open, permissionless, and trustless financial system. Popular DeFi platforms include Uniswap (for decentralized trading), Aave (for lending/borrowing), and Compound (for yield generation). DeFi aims to democratize finance, but it often faces challenges like high transaction fees, slow processing times, and scalability limits on its host blockchains.

Kaspa, as a high-performance Proof-of-Work (PoW) blockchain with its BlockDAG structure, doesn’t inherently focus on DeFi in the same way Ethereum does with its smart contract-heavy ecosystem. However, its unique properties position it as a potential foundation or complementary layer for DeFi applications, especially as the blockchain space evolves. Here’s how Kaspa relates to DeFi:

- Fast and Cheap Transactions

DeFi thrives on efficient transaction processing, but platforms like Ethereum often suffer from high gas fees and slow confirmation times, especially during network congestion. Kaspa’s ability to process blocks at one per second (with plans for 32+ blocks per second post-Rust rewrite) and offer near-instant confirmations (around 10 seconds) makes it a candidate for hosting DeFi-related transactions at a fraction of the cost and time. While Kaspa is currently developing native smart contracts, its speed and low fees could support DeFi use cases if extended with layer-2 solutions or sidechains. - Potential as a Settlement Layer

Kaspa’s scalability and security make it an attractive base layer for settling DeFi transactions. For example, DeFi protocols could use Kaspa to finalize payments, transfers, or collateral movements quickly and reliably, offloading the heavy lifting from slower or costlier chains like Bitcoin or Ethereum. Its PoW security ensures trustlessness, a core DeFi principle, while its BlockDAG architecture handles high throughput—critical for real-time financial applications. - No Native Smart Contracts (Yet)

Unlike Ethereum or Solana, Kaspa is currently developing code (reportedly to be released in 2025) to support smart contracts natively. Until the smart contracts are available, this limits Kaspa's direct role in DeFi. Most DeFi applications rely on programmable blockchains to execute complex logic (e.g., automated market makers or lending pools). However, Kaspa’s community and developers are exploring ways to integrate smart contract functionality, potentially through layer-2 solutions or partnerships. If successful, this could unlock full DeFi capabilities, leveraging Kaspa’s speed and efficiency as a competitive edge. - Bridging to DeFi Ecosystems

Kaspa could serve as a high-speed, low-cost bridge between DeFi platforms on other blockchains. For instance, wrapped Kaspa tokens (e.g., on Ethereum or Binance Smart Chain) could be used in existing DeFi protocols, allowing Kaspa’s native KAS coin to participate in lending, staking, or liquidity pools. This indirect integration relies on cross-chain interoperability, a growing trend in DeFi, and aligns with Kaspa’s focus on being a scalable, user-centric blockDAG. - Vision Alignment

DeFi and Kaspa share a philosophical overlap: both aim to decentralize and democratize systems (finance for DeFi, and currency/transaction processing for Kaspa). Kaspa’s emphasis on fairness (e.g., no orphan blocks, high block rate benefiting smaller miners) mirrors DeFi’s goal of removing gatekeepers. While Kaspa starts as a “pure” PoW coin akin to Bitcoin, its technological advancements suggest it could evolve into a broader platform supporting DeFi’s decentralized ethos.

Current State and Future Potential

As of now, Kaspa’s primary use case is as a fast, secure, and decentralized cryptocurrency for peer-to-peer transactions, not a full-fledged DeFi platform. Its lack of native smart contracts means it isn’t directly competing with Ethereum, Solana, or other DeFi giants. However, its revolutionary BlockDAG and GHOSTDAG technology provide a foundation that could disrupt DeFi indirectly—either by powering ultra-efficient transaction layers or, in the future, hosting DeFi applications if smart contract capabilities are added. Projects like Kaspa’s recent conversion from Go to Rust and community-driven innovation signal that its role in DeFi could grow, especially as the industry seeks scalable, low-cost alternatives to existing solutions.

Kaspa's speed, scalability, and PoW security make it a compelling option for supporting DeFi’s infrastructure, with its full impact likely hinging on future developments in programmability and interoperability.

Articles:

What Is Decentralized Finance (DeFi) and How Does It Work?

What is DeFi?

Video Explanations:

What is DeFi? (Decentralized Finance Animated)

How Yonatan Sompolinsky’s Kaspa Aims To Revolutionize Crypto and DeFi!

What is DeFi? | Decentralised Finance Tutorial For Beginners | Decentralised Finance | Simplilearn

What is DeFi in Crypto? Decentralized Finance Explained! (Ultimate Beginners’ Guide on DeFi )

What is DeFi? A Beginner’s Guide to Decentralized Finance

What is DEFI? Decentralized Finance Explained (Ethereum, MakerDAO, Compound, Uniswap, Kyber)

What are dApps?

A decentralized application (dApp) is a software application that runs on a blockchain or peer-to-peer network, leveraging its decentralized infrastructure instead of a central server. Unlike traditional apps, dApps operate autonomously through smart contracts—self-executing code stored on the blockchain—ensuring transparency, immutability, and resistance to censorship. They typically have open-source code, a user interface (like a website or app), and interact with a blockchain for data storage and logic execution. Examples include Uniswap (a decentralized exchange), CryptoKitties (a collectible game), and Aave (a lending platform), mostly built on Ethereum. dApps power decentralized finance (DeFi), gaming, NFTs, and more, offering trustless, intermediary-free experiences. However, their performance often depends on the host blockchain’s speed, cost, and scalability.

As of February 21, 2025, Kaspa—a high-speed Proof-of-Work (PoW) blockchain with its BlockDAG structure—is currently developing native smart contracts. However, if Kaspa introduces smart contracts (a possibility hinted at by its community and developers, potentially via layer-2 or core upgrades), its relationship to dApps could be transformative due to its unique features.

Kaspa’s BlockDAG and GHOSTDAG protocol enable it to process blocks at one per second (aiming for 32+ post-Rust rewrite), offering near-instant confirmations (around 10 seconds) and low fees. This outperforms many smart contract platforms like Ethereum, where high gas fees and slower transactions bottleneck dApp usability. With smart contracts, Kaspa could host dApps directly, leveraging its scalability to support high-throughput use cases—think real-time DeFi trading, gaming with instant moves, or NFT minting at scale—without compromising PoW’s security or decentralization.

For DeFi dApps, Kaspa’s speed could enable seamless lending, borrowing, or liquidity pools, rivaling platforms like Solana but with PoW’s trustless ethos. Gaming dApps could benefit from rapid state updates, enhancing user experience in competitive or interactive scenarios. Even social or governance dApps could thrive, using Kaspa’s fairness (e.g., no orphan blocks) to ensure equitable participation.

However, Kaspa’s success in the dApp space will hinge on its smart contract implementation—whether it’s Turing-complete like Ethereum’s, or more limited—and developer adoption. It’ll need robust tools (e.g., SDKs, documentation) to attract builders accustomed to Ethereum’s ecosystem. Competition from established players like Ethereum, Solana, and Binance Smart Chain means Kaspa must capitalize on its niche: ultra-fast, secure, and cost-effective PoW-based dApps.

When smart contracts arrive, Kaspa could redefine PoW’s role in the dApp landscape, blending Bitcoin-like security with Ethereum-like functionality. Its relation to dApps would shift from theoretical potential to a practical platform, potentially revolutionizing decentralized applications by solving scalability and cost issues plaguing current solutions—all while staying true to its decentralized roots.

Articles:

What are Decentralized Applications (DApps)?

Decentralized Applications (dApps): Definition, Uses, Pros and Cons

What are DApps? Everything there is to know about decentralized applications

How do dApps work?

Intro to decentralized applications

Video Explanations:

What are dApps? (12 Decentralized Application Examples)

What is a DApp? Decentralized Applications Explained!

What Is DAPPS | Decentralized Applications Explained | How DAPPS Works | Intellipaat

What is a dApp?

Decentralized Applications (dApps) - Explanation with Use Cases and 8 Examples

What is TradFi? Is it crypto?

"TradFi" is a shorthand term for "Traditional Finance." No, TradFi isn’t crypto. Traditional Finance (TradFi) is the opposite of the crypto world—it’s the established, centralized financial system that existed long before cryptocurrencies came along. It refers to the conventional financial system, including banks, Wall Street, investment firms, credit unions, stock exchanges, and other established institutions that have been the backbone of finance for decades (or even centuries). Think of it as the old-school way of handling money—checking accounts, mortgages, trading stocks through brokers, that sort of thing. It’s often contrasted with "DeFi" (Decentralized Finance), which is the newer, blockchain-based alternative that’s all about cutting out middlemen like banks and using smart contracts instead. TradFi is centralized, regulated, and runs on legacy infrastructure, while DeFi is more of a wild, tech-driven frontier.

Crypto, on the other hand, is a key part of Decentralized Finance (DeFi), which uses cryptocurrencies like Kaspa, Bitcoin, or Ethereum and runs on blockDAG or blockchain networks to bypass those traditional middlemen.

Crypto.com's Definition of TradFi:

Traditional finance, commonly known as TradFi, is a conventional approach to financial activities that relies on established institutions, regulations, and intermediaries like banks, insurance companies, and stock exchanges. It encompasses various services like banking, investment management, and asset trading. Key characteristics of TradFi include a centralized structure, where financial transactions are often facilitated through brick-and-mortar institutions like banks. In TradFi, financial decisions are often based on established financial models, theories, and analysis. Traders in TradFi generally follow traditional investment strategies and utilize financial instruments like stocks, bonds, and mutual funds. Although TradFi has been the dominant financial system for centuries, it faces challenges in terms of accessibility, efficiency, and inclusivity. The advent of technology and digital innovation has given rise to alternative financial systems like cryptocurrency and decentralized finance (DeFi), which aim to address the limitations of TradFi. (Source: https://crypto.com/glossary/tradfi)

Video Explanations:

Here's How Crypto Is Unique Compared To Tradfi

What does "tradfi" mean? | NFTs, Cryptocurrency, and the Metaverse Simplified and Explained

Why TradFi Will Be the Largest Customer of DeFi | Sergey Nazarov

Breaking Down the Disconnect Between TradFi & Crypto | Austin Campbell

Franklin Templeton INSIDER Reveals Crypto's Impact on TradFi!

David Mercer: TradFi & DeFi Converge | SALT Crypto 293

What is “Not Your Keys, Not your Money”?

If you control your private keys, you control your Kaspa, if you allow someone else to custody your Kaspa (you do not control the keys), you do not have control of "your" Kaspa, leaving on an exchange would be an example of trusting someone else with your Kaspa.

"According to proponents of the “not your keys” philosophy, a wallet on a centralized exchange does not truly belong to the account-holder. When withdrawals are paused, as they were by FTX in November, users lose access to their crypto. And if the worst happens, whether it’s the collapse of an exchange or a cyber-attack, those holdings could be lost altogether."

Articles:

Not Your Keys, Not Your Coins: Explained

Not Your Keys, Not Your Crypto: What to Know Before the Next FTX-type Meltdown

Video Explanation:

Research

Where are Kaspa’s White Papers?

Here are valuable resources for research:

GhostDAG White Paper

https://research.kas.pa

DAGKnight White Paper

What is GhostDAG?

GHOSTDAG allows us to make a chain out of the parallel blocks in the BlockDAG, which results in the same security guarantees provided by Nakamoto consensus (bitcoin), but with increased throughput and lower confirmation times.

For more information, read: https://kaspa.org/what-is-ghostdag-and-dagknight/

Where can I read community-driven information?

Kaspa Wiki - Kaspa is a community project, completely open source, no central governance, no business model.

Where can I find debunked myths about Kaspa?

Discover the truth about Kaspa at https://kasparchive.com/

What is the Kaspa Bounty?

People can earn $30,500 if they can prove Kaspa isn't what it claims to be. There is an open bounty to anyone who can mathematically prove that PHANTOM GHOSTDAG is wrong. Prove Kaspa does not Scale Nakamoto Consensus (Kaspa generalized NC, arguments in semantics will not be accepted as "proof"). If you are able to prove it, you will receive $30,500.00 paid in BTC. See x.com/kaspafacts for more information.

What happens to Kaspa and Bitcoin when quantum computers are viable?

https://arxiv.org/abs/1710.10377 - Quantum attacks on Bitcoin, and how to protect against them

https://arxiv.org/abs/1804.08118 - On the insecurity of quantum Bitcoin mining

https://arxiv.org/abs/2403.08023 - 51% Attack via Difficulty Increase with a Small Quantum Miner

What is DAGKnight?

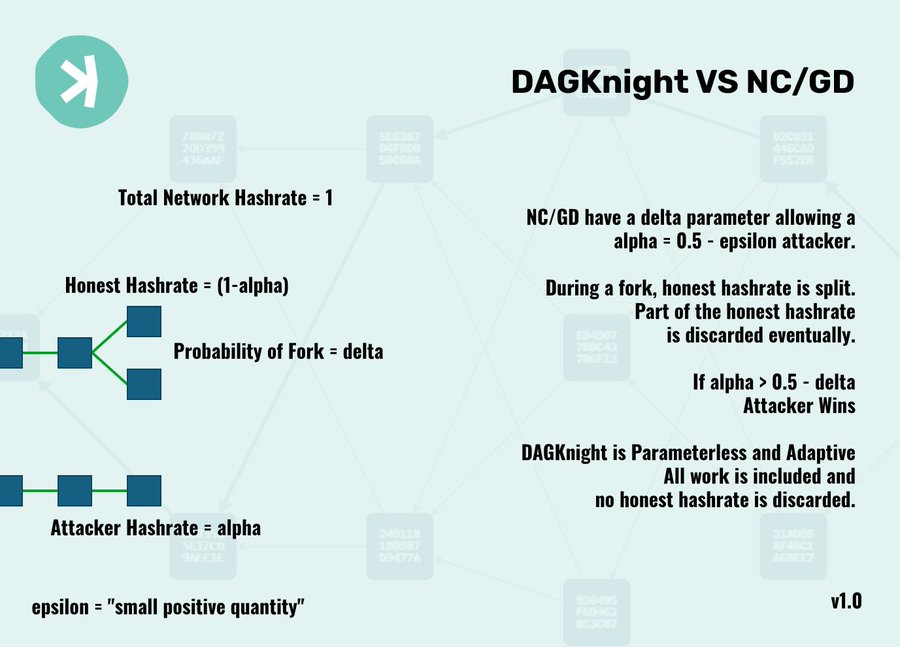

Michael Sutton and Yonatan Sompolinsky are working on a new ordering mechanism called DAGKNIGHT where the confirmation time adapts automatically by the internet speed. This means any improvement in the network conditions of the miners and any optimization in the block validation algorithm will also speed up the confirmation time.

DAGKNIGHT (DK) is a new consensus protocol, written by the authors of this KIP, that achieves responsiveness whilst being 50%-byzantine tolerant. It is therefore faster and more secure than GHOSTDAG (GD), which governs the current Kaspa network. In DK there’s no a priori hardcoded parameter k, and consequently, it can adapt to the “real” k in the network. Concretely, in DK, clients or their wallets should incorporate k into their local confirmation policy of transactions (similarly to some clients requiring 6 confirmations in Bitcoin, and some 30 confirmations). (Source: https://github.com/kaspanet/kips/blob/master/kip-0002.md)

Infographic source: https://x.com/KaspaFacts/status/1895452419229892693

DAGKNIGHT White Paper:

The DAG KNIGHT Protocol: A Parameterless Generalization of Nakamoto Consensus

Articles:

What is GHOSTDAG and DAGKNIGHT?

The Master of Time: How DAGKNIGHT Solves an Impossibility Result Unachievable by Bitcoin, Ethereum and Classical BFT Models

The DAG KNIGHT Protocol — Elevating Kaspa

The Rise of DAG Knight: A Protocol in Shining Armor

Video Explanations:

What is DAGKNIGHT? (Short explanation by Kaspa Founder, Yonatan Sompolinsky)

DAG Knight presentation - CESC Day 1 w/ Yonatan Sompolinsky

Kaspa Ghostdag 101 (Presented by Shai (Deshe) Wyborski)

Kaspa Coin DAGKNIGHT Explained

What Is DAGKnight And GhostDAG?

What is DAGKNight?

Kaspa's Protocol Explained Evolution From GHOST to DAGKNIGHT

Kaspa's DAGKNIGHT Explained

Kaspa's Endgame: How DAGKNIGHT Revolutionizes Crypto